Company Overview

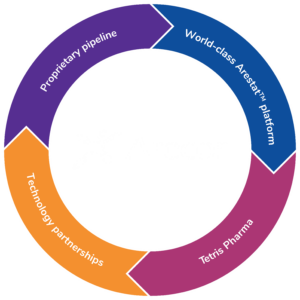

Arecor is a globally focused biopharmaceutical company enhancing existing therapeutic products to enable patients to live healthier lives. The Company has a revenue-generating commercially focused business model, offering significant potential future returns from successful drug development, de-risked through the reformulation of existing medicines using its Arestat™ technology platform, and a pan-European commercial product sales platform, through the acquisition of Tetris Pharma.

The Company has established a well-balanced development pipeline consisting of a combination of partnered programmes, coupled with select in-house best-in-class proprietary products with material upside potential from licensing and has a proven track record of partnering with pharmaceutical companies.

Arecor’s current focus of internal proprietary product development can be divided into two product classes: diabetes and specialty hospital care. In addition, the Company also develops novel enhanced formulations of its partners’ biological products that include biosimilars, biological products and vaccines, which are derived from the Company’s formulation development and technology licensing programmes and are referred to as “Technology Partnerships”.

Contact: ir@arecor.com